Key Takeaways

- Get clear on your finances before making big purchases to avoid future setbacks.

- Set meaningful short- and long-term goals to keep spending purposefully.

- Use practical rules, such as the 50/30/20 rule, to simplify budgeting and align spending with your values.

- Automate savings and routine financial check-ins to keep momentum on goals.

- Evaluate lifestyle upgrades carefully to ensure they don’t jeopardize your financial future.

- Make well-researched, informed purchases that align with both your current needs and future aspirations.

Table of Contents

- Understanding Your Financial Landscape

- Setting Clear Financial Goals

- Implementing the 50/30/20 Rule

- Automating Savings and Investments

- Evaluating Lifestyle Inflation

- Conducting Regular Financial Check-Ins

- Making Informed Purchasing Decisions

- Seeking Professional Financial Advice

Understanding Your Financial Landscape

The first step in any major purchase decision—whether it’s a home, car, or investment—is understanding your true financial position. Start by tracking your income and categorizing your expenses into three key areas: essentials, leisure, and savings or investments. This clear financial snapshot can prevent costly missteps and lay the foundation for every choice that follows. For those considering a home, Magnolia real estate experts The Greely Group can guide you toward investments aligned with your budget and plans.

Budget transparency today directly affects your ability to seize opportunities tomorrow. Frequently, people overlook how small, repeated expenses can add up or fail to account for irregular but important costs, such as insurance or holiday travel. Proper planning helps maintain stability both now and in the years ahead.

Setting Clear Financial Goals

Once you know where your money is going, it’s time to set clear financial goals. Short-term objectives, such as creating an emergency fund or reducing high-interest debts, should be balanced with longer-term priorities, like planning for retirement, buying a home, or financing education. Setting and regularly revisiting these goals keeps daily spending purposeful and prevents impulsive decisions from derailing your progress.

Think beyond the basics: What kind of life do you want to lead in the next five, ten, or even twenty years? Put those aspirations on paper and break each goal down into actionable steps.

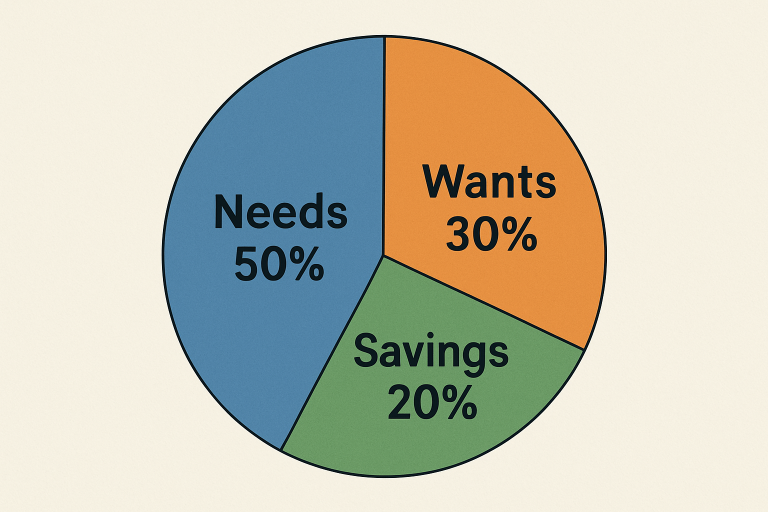

Implementing the 50/30/20 Rule

Budgeting doesn’t have to be overwhelming. The 50/30/20 rule is a time-tested structure for striking a balance between present enjoyment and future security. Dedicate 50% of your take-home pay to essentials like housing, utilities, and groceries. Use 30% for discretionary purchases, such as entertainment and dining out. The final 20% should be allocated to savings and investments, supporting your most important long-term goals. By adhering to this balanced approach, you can enjoy your lifestyle now without sacrificing your bigger dreams.

Automating Savings and Investments

Consistency is critical in building financial security. Automatic transfers—from your checking account to a savings or retirement account—transform good intentions into action. With automation, you’re less likely to spend what should have been saved, and you steadily accumulate wealth with little ongoing effort.

The “pay yourself first” philosophy is a simple yet powerful concept. Prioritize your savings and investments every time you get paid–before you allow discretionary spending to eat away at your progress.

Evaluating Lifestyle Inflation

As you earn more, it’s tempting to upgrade your lifestyle—bigger home, nicer car, fancier vacations. While rewards for hard work are well deserved, be mindful that increasing spending proportionally with income, a phenomenon called lifestyle inflation, can quietly stall your financial trajectory. Pause before making major upgrades and ask yourself if the value added actually aligns with your long-term objectives.

Occasional indulgences are healthy, but unchecked lifestyle creep can erode your ability to save for big goals. Balance any uptick in spending with proportional increases to savings and investments.

Conducting Regular Financial Check-Ins

Schedule monthly or quarterly financial check-ins to assess your progress. Review how actual spending compares to your plan and update goals as personal needs shift—whether that’s a career change, a new family member, or changing priorities. Regularly adjusting your plan ensures it remains relevant and supportive of both your everyday and future needs.

Making Informed Purchasing Decisions

Every significant purchase should fit within your financial framework. Take the time to research options, compare quality and price, and consider how a purchase will impact both your current lifestyle and long-term objectives. Don’t let excitement or external pressure rush a decision. Smart, informed buying supports not only happiness in the present but also healthy finances for years to come.

Seeking Professional Financial Advice

If the process of budgeting, goal setting, and evaluating major purchases feels overwhelming, consulting with a financial advisor can provide clarity and personalized direction. Experts analyze your entire financial picture and deliver trusted recommendations tailored to your current life stage and aspirations.

By maintaining a disciplined yet flexible approach—rooted in knowledge, planning, and self-reflection—you’ll enjoy a high quality of life now while building security, freedom, and opportunities for the future.